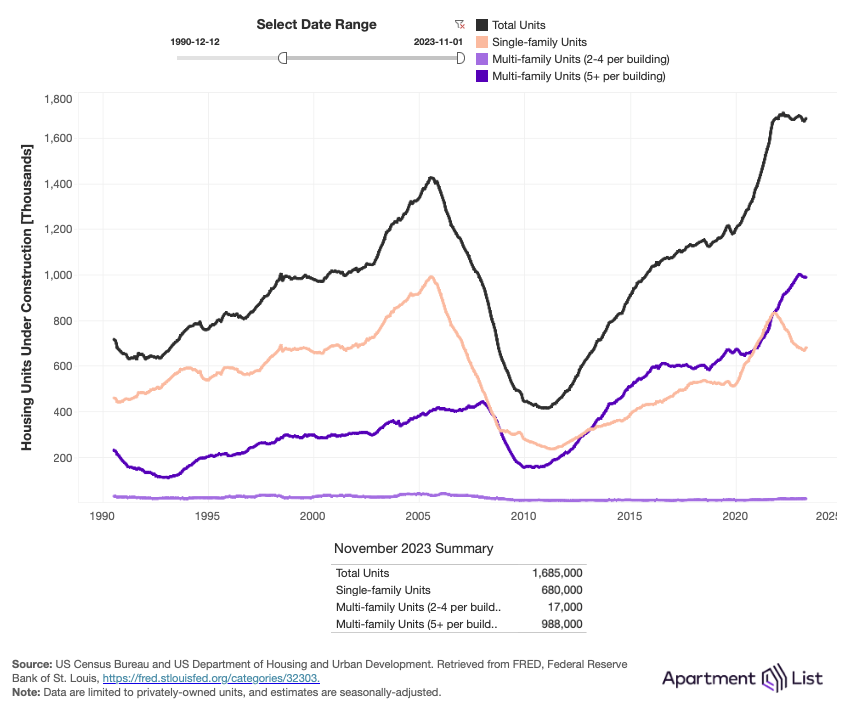

Last year, I wrote about how Salt Lake City wants to build a new linear park around its downtown. That post can be found, here.

Fast forward to today, and the city’s Department of Economic Development has just published a new comprehensive 215-page study that supports turning Main Street into a pedestrian promenade.

Specifically, the area running from South Temple to 400 South, and including 100 South from Main to West Temple:

As part of the study, they highlight a number of successful case studies from around the world, including 16th Street Mall in Denver, Bourke Street Mall in Melbourne, and Queens Quay here in Toronto.

In the case of Denver, they cite the one-mile stretch as single-handedly generating over 40% of the city’s total downtown tax revenue! And in the case of Toronto, they refer to Queens Quay as a global destination. (Toronto readers, do you agree?)

Like most city building initiatives, this vision is will take years to realize. But it’s interesting to note that, of the eight design alternatives included in the study, there is already one clear preference within the local community — option B.

Option B is a pedestrian/transit mall, but with multi-use trails. In other words, it is a no-cars-allowed alternative that would still allow bicycles and scooters. Here’s the street section:

If you’d like to download a copy of the full Main Street Pedestrian Promenade Study, click here.